Ponzi VS Pyramid Scheme-Are They The Same?

Today, I’m going to walk you though a ponzi vs pyramid scheme. Many people use these two different words interchangeably, but the truth is they are different. There are many similarities to the two schemes. Both have cost people millions and billions of dollars.So, I am going to go into a super in-depth analysis of the two words.

Today, I’m going to walk you though a ponzi vs pyramid scheme. Many people use these two different words interchangeably, but the truth is they are different. There are many similarities to the two schemes. Both have cost people millions and billions of dollars.So, I am going to go into a super in-depth analysis of the two words.

Ponzi Scheme Defined

It can be defined as a fraudulent investing scam where “early” investors see returns on money invested from “new” investors instead of profit from the operator. Unlike a pyramid scheme, you are investing one time into the scheme. There is usually no “real” product or investment actually happening. You are depending solely on “new” investors for returns on your investment. Once the cycle of new investors end; Ultimately, the scheme will collapse.

The cash flow will exceed the inflow, thus, not being able to sustain operations. The only people that make money are the first people to get into the scheme. The word, Ponzi scheme, was named after Charles Ponzi. He was famous for some of the earliest schemes in history in the 1920’s. He scammed people out of a couple hundred million dollars, in today’s money, before people finally became suspicious of his illegal activities.

Often times, people will receive high, short-term returns or unusually consistent returns. This is what makes it very attractive for people looking to make quick money. One of the biggest schemes in recent history was performed by Bernie Madoff, who didn’t get caught, until finally confessing to actually doing it. He was able to con people out of almost $65 billion dollars before everything finally caught up to him.

How Does It Work?

You’re at a party, having a good time. At one moment, you decide to take a break from the party. Maybe you decide to go outside to get some fresh air for a minute. When suddenly, a guy, you don’t know, walks up to you to have a conversation with you. He took a liking to you because you seemed like the type of guy that knows a great opportunity when it’s presented to you.

He gives you a tip on how to get some great returns on your money. Your told it’s a sure thing, and everyone else that has invested is already seeing substantial returns on investment. Of course, you being the skeptic you are decide to talk to your friends about it first. Come to find out, some of your friends have already invested and are seeing great returns. So you decide to invest a few thousand dollars.

The problem is, the money you just handed this guy is what will pay for the returns of your friends. Soon after your investment, you start seeing returns. OK. Looks like you made a good choice to invest. Now, you decide to tell your friends about the opportunity. The ones that join are the one that will being supporting your returns now. This cycle goes on until eventually there are no more investors left.

Now that the cash intake has diminished, you aren’t seeing anymore returns. The last ones to invest never see any money back. You decide to call the promoter of this investment opportunity. The phones disconnected, and you have no other way of contacting him. He has vanished and so has the rest of everybody’s money.

If you invested early, you may get your money back. However, for the rest of the people, money is lost without a way of getting it back. There was never any actual investment opportunity. You and hundreds or even thousands of other people just supported the promoters lavish lifestyle until people stopped joining. Then he disappears with the rest of the money once he realizes he can’t sustain anymore payments to the investors.

Simplified, here are the basic steps of a ponzi scheme.

- Convince a few people to invest in the opportunity

- After a specific amount of time, return a portion of the invested money to the investor with interest

- Through word of mouth, convince others to invest by showing your successful results

- Repeat steps one through three. Once investors stop flowing in, step two will change to taking the investors money and running somewhere else to create a new life.

Who Was Charles Ponzi

The man that “Ponzi scheme” was named after was not the first to execute this type of investment fraud. However, he did become famous for performing one of the biggest frauds of his time.  Charles Ponzi, born as Carlos Ponzi, was an Italian immigrant born in Parma, Italy in 1882. He came to the U.S. in 1903 with only a few dollars because the rest of savings got gambled away on his trip to the states. He arrived in Boston where he took on many different odd jobs and getting fired from a few. One job he was fired from was when he was waiter at a restaurant. He skimmed some extra money from customers and was caught for stealing.

Charles Ponzi, born as Carlos Ponzi, was an Italian immigrant born in Parma, Italy in 1882. He came to the U.S. in 1903 with only a few dollars because the rest of savings got gambled away on his trip to the states. He arrived in Boston where he took on many different odd jobs and getting fired from a few. One job he was fired from was when he was waiter at a restaurant. He skimmed some extra money from customers and was caught for stealing.

At one point, he moved to Montreal, where he managed to get promoted to a bank manager. Eventually the bank would fail because of financial issues. Before failing, the bank started providing interest payments through money from new bank accounts opening instead of profit from investments.

After failing, Charles Ponzi had no money. At one point, he wrote himself a check from the checkbook of a former bank customer. Canadian police caught on, and eventually arrested him for fraud. After three years of being in the penitentiary, he was released and traveled back to Boston.

Eventually, he tried making money by selling his ideas to other companies, but never prevailed to attract any business. Weeks later, Charles would receive a letter in the mail from a company in Spain asking about the idea he was selling. Inside the letter was an international reply coupon( voucher that allows you, the sender, to pay for the postage so the recipient can easily send a reply letter).

The IRC gave him a great idea. Italy was in a big recession, after world war one, making the reply coupons dirt cheap in that country compared to the U.S. rates. So, Charles would buy IRCs in Italy and sell them for a better price in the U.S. This was legal, and Charles reported to make profits of 400% off this method.

Having made money, he decided to look for investors and promised high returns in short periods of times. Things worked out and he and set up his company called ” Securities Exchange Company” to promote is business.

Word spread of the great returns and investors flocked in like birds flying south for the winter. However, Charles wasn’t investing in coupons anymore. Instead he was just paying off investors with money coming in from newer investors. By May of 1920, Charles had made approximately $4.5 million dollars in today’s money.

Eventually, suspicion started coming in about how was it possible for Ponzi to bring in such high returns in such a short amount of time? Some people, from The Boston Post, eventually started doing their own investigation. After some time, and receiving help from other sources, The Boston Post started asking hard questions in the paper about Charles Ponzi’s company.

Charles Ponzi’s scheme eventually started getting unraveled, and caused mass amounts of people asking for their money back. At this point, Ponzi was getting deep in debt as his business was collapsing. IN August of 1920, Securities Exchange Company came crashing down while Ponzi was forced to surrender to the Feds. He spent A few years in prison, only to get tried at the state level.

Charles would escape to Florida after posting bail. Running schemes down there, until eventually thing got caught up to him again. In an attempt to escape the Country, back to Italy, he would be caught and sent back to Boston to finish his trials and prison terms. After finishing his prison terms, he would be deported back to Italy where he spent the rest of his life in poverty before passing away.

Charles Ponzi ended up serving a total of 17 years in prison for his fraudulent scams, and caused investors to lose a total of $225 million dollars in today’s money.

Basics Of A Ponzi Scheme

Though, Charles Ponzi used international reply coupons to hide his Ponzi scheme, it can take form in many different ways. The basis is simply paying off older investors with newer investors money. It doesn’t really matter what idea is sold as long as the basis is covered.

Many people fall prey to these scheme because of the idea of making tons of money fast. As long as you can convince the first few people to invest, The scheme should work. Once those investors get paid, word of mouth will spread like a wild fire towards new victims of the “opportunity”.

As new investors decline and older ones start pulling out the Ponzi scheme will crumble as it is just not sustainable without the cash flow of new investors.

Bernard Madoff’s And Allen Stanford’s Ponzi Schemes

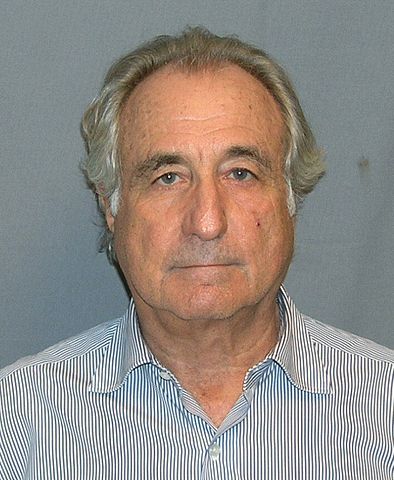

Bernie Madoff

Two of the biggest ponzi schemes in history were pulled off by these two separate con men. Bernard Madoff was a well-known respected business man for a very longtime. At one point he was president of board of directors for NASDAQ.

He was known as a legend on Wall Street, and opened up his own company in 1960 called Bernard L. Madoff Investment Securities LLC. It was operated as a securities broker/dealer business. Bernard promised moderate returns on investments, and stayed under the radar for decades because of the accomplishments that Bernie had achieved.

No one is completely sure when the fraud had begun. Some people believe it was as early as the 1960’s, when Bernie opened up his company, while Bernie had stated himself it was somewhere in the early 90’s. His investment scam attracted Banks, charities, professional athletes, actors, and regular individuals to invest. Though it is reported to be around $65 billion dollars in money lost, it was about $20 billion dollars that had been invested.

The $65 billion included the principal plus returns of interest. When the economy hit a down point in 2008, everything started unraveling. About $7 billion dollars was being asked to be withdrawn, and there were no new investors. Madoff couldn’t afford to keep going and eventually confessed to his sons that the whole operation was a huge lie.

The sons turned Madoff in to the FBI, and Madoff would go on to receive a 150 year prison sentence. Many business and charities had to close down after the exposure of the scam, and even Madoff’s own son Mark committed suicide two years after his father’s arrest.

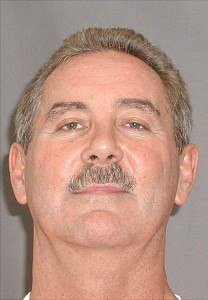

Allen Stanford

Shortly after Madoff’s scheme was unraveled Stanford was indicted. Though not as big as Bernie’s fraud, Stanford managed to run a $7 billion dollar ponzi scheme. He claimed to be a self-made billionaire and sold certificates of deposits to create his elaborate scheme.

Another scheme lasting over a decade, Standford got investigated multiple times by the SEC. Because the SEC could never could gain enough evidence to prove Allen Standford was running a ponzi scheme, He used it to his advantage.

Anybody that was skeptical about investing, he would imply that the SEC never had issues with him and they come all the time. This was a way of comforting the investor and it worked many times. When everything finally caught up to him, he was sentenced to 110 years in prison.

He still claims his business was legitimate, and blames the government for intervening. Over 20,000 people had invested with Stanford and many may never get their money back. Those that do will probably receive pennies back on the dollars invested.

Warning Signs Of A Ponzi Scheme

Even though these types of scams were named after Charles Ponzi, Ponzi schemes have been going on for a long time and won’t stop being performed anytime time soon either. Unless you get in early, you could lose your life savings if you aren’t too careful.

In Bernie Madoff’s scheme, Businesses closed their doors after losing their money, and some individuals were left with nothing after investing millions. You can avoid this by looking for these warning signs.

- If you are guaranteed big returns 10%,20%, then it’s probably too good to be true (Charles Ponzi was giving returns of 50% and 100%)

- If there is no real collateral given, just some promissory note or statement, it could be false

- If the returns are extremely consistent, this could be a red flag. Markets are bound to fluctuate

- Lack of details where the money comes from

- Any guaranteed return is false. Every investment has some type of risk

- Claims that no one loses money, or the companies track record is flawless on investments

- If the person is secretive about the investment because other companies might steal their strategy

- The higher the investment, the higher the risk. If stated otherwise, it just wouldn’t make sense

- If the “opportunity” is designed specifically for your kind of people; watch out

- Word of mouth is the best way these schemes receive money. Just because your friend is “making” money doesn’t guarantee you will

- “This is the only time time you can get in.” Those are the words you should watch out for most. It just sounds like the company won’t be around for awhile

Always do your research before joining anything. Even if you are one of the first ones in on this scheme making money; once it gets shutdown, the courts could be coming after you for reparation to help other victims that did lose money.

It is always best to diversify your portfolio instead of laying all the cards on the table with one investment. It doesn’t matter what the opportunity is.

What is a Pyramid Scheme

This an illegal business model, in many countries, that typically involves promised payments to participants for recruiting other people into the scheme. Often times pyramid schemes are disguised as multilevel marketing companies. Instead of sales of their products, they pay participants for recruiting other people that pay a membership fee for joining.

Only the people at the top will make any good money. Close to 90% of people will either break even or lose money in this type of opportunity. Think about all the effort that is put in, but with nothing to show for. These methods of making money are unsustainable, and will eventually collapse when things become too saturated to recruit more people into the scam.

How Does It Work

I used to go door to door selling AT&T home services. This one day I’m making my laps around the neighborhood, and I bump into this guy while I’m walking around. He asks me what I’m doing. So I explain it to him. He acted like he was almost interested. He asks me for my phone number, which I hand him, and says when we have more time we can discuss a few things.

In my mind, I was thinking I was going to make a potential sale with this guy for what I was selling. My job was commission based, so anyone that showed interests I was more than happy to let them call me back later.

A few days later, the guy that I met, calls me and asks to meet up. Ya sure, of course, I would love to meet up. I’m obviously trying to make money. We meet up at Taco bell. He brought his wife and friend along, which I was fine with. Maybe that means more potential sales. We meet up, he decides he was gonna eat and offered to buy me Taco bell as well.

I respectfully declined, and we started talking “getting to know each other.” After about 20 minutes of talking, and learning what I like to do, and what my future plans where. College, traveling, where I’m from, etc… He goes and takes out his laptop.

Before showing me anything, he asked me how would I like to make money doing things I already do. Buying groceries, seeing movies, etc… At this point, I grew a suspicion about why I was really there. It pertained to nothing I was doing. However, I went along with it and agreed making money for things I already do would always be a nice way to make a living.

Then it happened, he starts showing me this whole compensation structure where I would make money by purchasing products I already use, but instead going through this company for them. Then after using the products, I would go to my friends and recommend those same products to them that I am now using so they can make money too.

Just a few weeks before, one of my own friends tried presenting me with the same exact opportunity, which I turned down. Now I’m stuck with this guy at Taco bell, who I hardly know, and I’m forced to sit through his presentation of things I kind of already knew about. I did play along though because I was always curious about other ways to make money, and this guy seemed to have more experience on the subject than my friend did.

I asked about the prices and how everything worked. After learning about the compensation structure, and how everything else worked, I told the guy I need to do my own research and do some compare and contrast with other products. After writing some notes down, we departed and I went to the supermarket.

I compared the prices between what I used compared to what the other company was offering. I wrote down prices of my shampoo, drinks, toothpaste, etc… I then compared to what I would be paying with the other company.

Come to find out, some of the products I was currently purchasing now were sometimes 2X-3X cheaper than what I would be paying if I switched over. After doing my research, We met up again to go over everything.

When I confronted him about how I wouldn’t really be making money, he went into how his products were more concentrated and I would be using less so in-turn I would be spending less even though the products were more expensive. Plus, he stated how his products are “healthier” for you.

The compensation plan was complicated since whoever was in my downline; I would be making money off their purchases, plus the guy I signed up under would also be making money off my downline’s purchases. The more levels in the structure, the more people I would have to have using these products to make any “decent” money off of.

The problem with this is the more people that signed up in my area, the more saturated it was. Now, instead of 10 people looking for people to join in my local market, There would be 100 people recruiting others. Then after that, there would be 1,000 people in my local market recruiting, and so on, and so on…

With this in mind, plus the fact I was mathematically calculated paying more for these “healthier” products, it just didn’t make sense to me to join. Even though the business proposition proposed to me involved selling products, instead of just recruiting people. You should be able to see how you would eventually run out of potential clients to recruit into the pyramid scheme.

Eventually making the pyramid collapse after thousands of other people joined. Plus, even if you were just into healthier products, most of these aren’t FDA approved. Meaning that nothing is exactly proven to perform the health benefits that are claimed to make this product worth purchasing.

MLM VS Pyramid Schemes

When you hear multilevel marketing or network marketing, often it will be associated as a pyramid scheme. Though MLM companies are legitimate and legal, often times pyramid schemes will mask themselves as multilevel marketing companies. This is the easiest way for them to be able to recruit people. There are some differences though, that you have to understand.

- First and foremost, MLM companies consist of a marketing strategy while pyramid schemes is a fraudulent scheme

- There are no “real” products sold in pyramid schemes. However sometimes they are disguised with products that are usually over inflated in price.

- While both consist of a multilevel compensation plan, if you are making more money on recruits than actual product sold then it is most likely a pyramid scheme.

- If it is a legitimate MLM company, they will buy back unsold inventory vs. pyramids not really having anything to buy back

- Any job you do involves hard work. If there are promises of easy and quick money then you are more than likely about to be involved in a pyramid scheme.

- Even if there is a product, if the emphasis is on recruitment to make good money then it is a pyramid scheme

- Though structured the same, in a legitimate multilevel company, it doesn’t matter what level of the structure you are on. You can theoretically earn more than the person who signed you up while the it’s the opposite for a pyramid scheme.

- More often than not the companies and people that defend themselves the most about being involved i a pyramid scheme are the ones that usually are involved.

- When you are shown “testimonies” of people “living the dream” then it is probably a pyramid scheme. Legitimate companies don’t need to boast about some lavish lifestyle.

- If someone goes and defends their MLM company by telling you how your”job” is a pyramid scheme because there is somebody at the top that makes all the money. You better run. While most people may get stumped by that statement being made. People forget to realize that corporations aren’t constantly trying to recruit an unlimited amount of workers. They also don’t pay employees for bringing in new recruits.

While it can be difficult to distinguish whether or not a company is an actual pyramid scheme because of how similar they can be, remember some of the comparisons made here.

Always do your own research, and make sure you are asking for some annual income reports so you can see how much people are actually make with the company.If no one is willing to provide those reports, then the company or person is hiding something and it would be in your best interest to just say “No”.

Vemma Is The Most Recent MLM Disguised As A Pyramid Scheme

I will not go into much detail here as I have already written a review of Vemma. I would like to just mention, however. At this moment, Vemma is fighting the courts because they were just recently exposed as a pyramid scheme. They promised false lies with unrealistic testimonies of “successful” people.

They targeted mostly college kids into their scheme. only 1.62% of distributors made over $44,000 last year of the people that joined Vemma. Compare that to the U.S. median income last year of almost $52,000, and you would realize you would have been better off just sticking to your daytime job than joining Vemma to make some “extra” cash.

Ponzi Scheme VS Pyramid Scheme

Now that I have explained what each scheme is. Let’s put them together for comparison. The biggest difference you will find is while they both involve paying older investors on newer investors money. The main consensus is Ponzi schemes involve people investing one time and expecting returns, while pyramid schemes involves constant recruitment of newer investors to buy in to the “opportunity”.

People involved in Ponzi schemes believe they are investing in some kind of security. While in pyramid schemes, people are usually aware that they need to recruit new people to make any kind of money. Both are illegal, and both will at some point collapse. It’s inevitable. In both schemes you will not be able to sustain forever. You will eventually run out of recruits or run out of investors.

People involved in ponzi schemes are usually innocent for they don’t realize what they are getting to. People involved in pyramid scheme are usually innocent as well because they aren’t aware either. But, they are the ones who basically create more victims as they are directly promoting the illegal activities of the company towards you.

Overall they are pretty similar, and I think I have done a good job explaining both of them in detail above. They both can involve thousands or even hundreds of thousands of people. As well, they both should be avoided.

Ending Thoughts

Now that you have read in depth of a Ponzi scheme vs a pyramid scheme, how do you feel between the two? Which one would you consider worse? They can be very similar and are often referred in the same context even though they are slightly different. To give my personal insight, I do feel ponzi schemes are worse in the matter because of the fact that they have cost people more money than A pyramid scheme.

However, pyramid schemes vacuumed away so much time from participants only to do all that work for nothing. You don’t need money to be happy, but time is important as life is so short. Pyramid schemes make people lose time, and that is one thing that can never be replaced. Money can.

Avoid Ponzi And Pyramid Schemes, Start A Real Business Here

Questions And Concerns?

For those that made to the bottom of the page, thank you for reading. I tried to make this article as in depth as I could get it. On that note, if you have and questions, think I’m missing anything, or have your own opinion to express. Please leave comments.

I will be sure to reply to them all. Also, check out my article “Affiliate marketing vs Network Marketing” so you can understand more about MLM companies and the differences compared to the marketing strategy that I use. Affiliate marketing.